Metro Bank has today become the first UK bank to partner with award winning AI scam detector, Ask Silver – allowing customers to spot scams more easily and protect them from fraud.

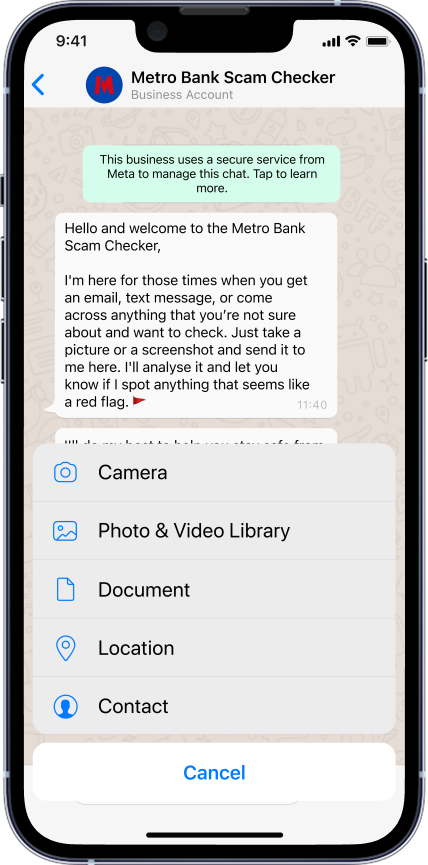

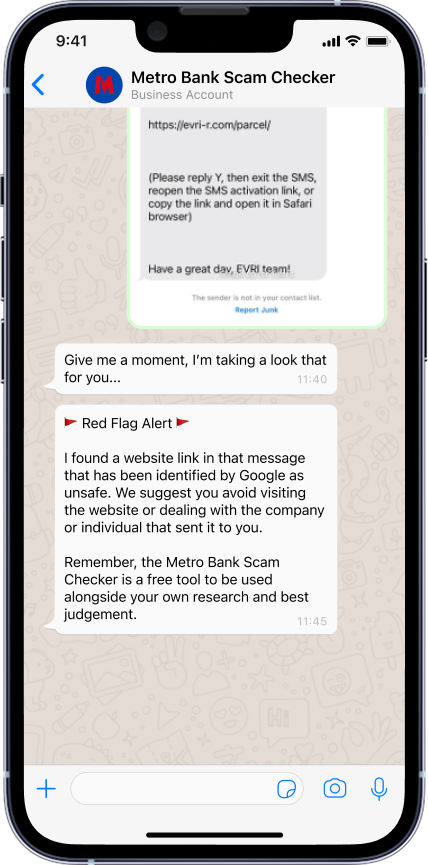

The Metro Bank Scam Checker powered by Ask Silver uses bespoke AI technology to enable Metro Bank’s personal and business customers to instantly check whether they are at risk of a scam. Using their phone or tablet, Metro Bank customers can now simply take a photo or screenshot of any email, website, letter or leaflet they are suspicious about and using the Metro Bank Scam Checker send it via WhatsApp. Ask Silver will then use the power of AI to spot if the communication is fraudulent and provide suggestions for next steps on staying safe – in just minutes. This feature, which is simple and easy to use, will help give customers a route to peace of mind and has the potential to stop scams from taking place.

In recent years scammers have introduced sophisticated methods to target the UK’s finances, including impersonation fraud, where criminals pose as a trusted organisation to try and obtain access to a customer’s account. In many instances, it can be difficult for customers to spot a fake, but Metro Bank’s partnership with Ask Silver aims to help tackle the uncertainty, helping prevent customers from falling victim to impersonation fraud and providing valuable friction against fraudsters.

“This new partnership with Ask Silver is a game changer in protecting customers from fraud and helping to stop crime,” explains Baz Thompson, Head of Fraud, Metro Bank. “We take the security of our customers very seriously and constantly review how we can help them fight fraud. Criminals often play on urgency and speed to trick people into parting ways with their hard-earned cash. Being able to offer a service where customers can know in minutes whether something is fraudulent provides an essential barrier to staying one step ahead of fraudsters.”

Combatting scams in the UK

UK Finance data shows more than £1 billion was lost to fraud including scams in 2023[i]. More than 4 in 10 of all crimes[ii] in the UK are scams or frauds. When it comes to authorised push payment fraud, more than three quarters (76%) starts online and 16 per cent started through telecommunications networks[iii].

Metro Bank customers will be able to use the service for free, receiving a scam alert on their mobile phone if communication is found to be fraudulent. Ask Silver will also automatically report it to the correct authorities on the customer’s behalf. Notifying the right authorities about current fraudulent communications helps both the financial services industry and the police fight crime.

Metro Bank would never pressurise its customers to act quickly or direct customers to a webpage that requests any of the following: user IDs, passwords, one-time passcodes, PINs or other secure information. Metro Bank will also never discuss account activity or potential fraud via email or ask a customer to make payments or transfers to another account.

Ask Silver was founded by friends Alex Somervell and Jonny Pryn after a close family member of Alex's was scammed out of £150,000 - most of their life savings. This experience inspired Alex and Jonny to create Ask Silver and they are now on a mission to help consumers beat the scammers.

Alex comments: “We’re thrilled to join forces with Metro Bank to empower its customers in the fight against fraud and scams. This partnership marks a pivotal step in safeguarding financial security and we hope it’s just the beginning. We’re building the most human-focussed anti-scam company and partnering with customer-focused financial institutions like Metro Bank is core to that. We want work together with banks, public institutions and the public to keep our loved ones safe, as well as their hard-earned money.”

Sources:

[i] UK Finance 2024 Fraud Report

[ii] National Crime Agency

[iii] Source: UK Finance 2024 Fraud Report